How we’re different: At Townsend Appraisals LLC, we limit our market area to Contra Costa and Alameda Counties. This enhances the quality of our appraisals and the level of trust that our clients experience. We have 36+ years of combined appraisal experience. Combined with commitment to be active in the appraisal community through speaking at Appraisal Institute conferences and other volunteer activities, we stay aware of the latest market trends, and have a network of skilled and competent professionals.

How we’re different: At Townsend Appraisals LLC, we limit our market area to Contra Costa and Alameda Counties. This enhances the quality of our appraisals and the level of trust that our clients experience. We have 36+ years of combined appraisal experience. Combined with commitment to be active in the appraisal community through speaking at Appraisal Institute conferences and other volunteer activities, we stay aware of the latest market trends, and have a network of skilled and competent professionals.

California

The Story of Townsend Appraisals

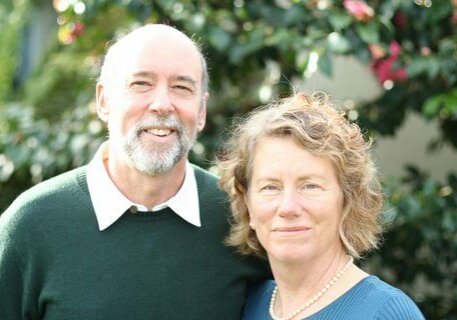

The Story of Townsend Appraisals LLC starts in 1986. Nancy began appraising when interest rates started to drop after they had been at historical highs for a number of years. She was mentored for five years by Donna Neff, an experienced appraiser in Orinda. In 1991, she started her own business. To optimize her competence and skills as an appraiser, she obtained her SRA designation from the Appraisal Institute in 1993. She is a certified expert witness in Contra Costa and Alameda County Superior Courts, as well as in Alameda Bankruptcy Court. Her husband Peter joined her in 2001, having previously worked for over twenty years as a manager in metallurgical engineering. His analytical mind has been a great contribution to Townsend Appraisals LLC.

The Story of Townsend Appraisals LLC starts in 1986. Nancy began appraising when interest rates started to drop after they had been at historical highs for a number of years. She was mentored for five years by Donna Neff, an experienced appraiser in Orinda. In 1991, she started her own business. To optimize her competence and skills as an appraiser, she obtained her SRA designation from the Appraisal Institute in 1993. She is a certified expert witness in Contra Costa and Alameda County Superior Courts, as well as in Alameda Bankruptcy Court. Her husband Peter joined her in 2001, having previously worked for over twenty years as a manager in metallurgical engineering. His analytical mind has been a great contribution to Townsend Appraisals LLC.

What is a real estate appraiser?

A common misconception is that real estate appraisers and real estate agents do the same thing. Actually, our training and our function is very different. Appraisers estimate the value of property. Agents sell property. Appraisers have much stricter licensing requirements. Appraisers must have a minimum of 2000 hours of supervision by a mentor (2500 for a certified level which we have), at least 30 months of acceptable experience, successfully complete a number of increasingly sophisticated courses, and pass a rigorous licensing exam. The continuing education requirements for appraisers are much more rigorous as well, than they are for agents.

A common misconception is that real estate appraisers and real estate agents do the same thing. Actually, our training and our function is very different. Appraisers estimate the value of property. Agents sell property. Appraisers have much stricter licensing requirements. Appraisers must have a minimum of 2000 hours of supervision by a mentor (2500 for a certified level which we have), at least 30 months of acceptable experience, successfully complete a number of increasingly sophisticated courses, and pass a rigorous licensing exam. The continuing education requirements for appraisers are much more rigorous as well, than they are for agents.

Appraisal Fees Vary By Appraisal Type

The most common thing we are asked on the phone is “How much does an appraisal cost?” The answer is that it depends on the property being appraised, of course, and the purpose of the appraisal. If you want an estimate of value without us inspecting the property at all, we could charge as little as $150. If we don’t have to inspect the interior of the property and the purpose is not for divorce or litigation purposes, the fee can be as low as $275. Appraisals that require an inspection of the interior of the property run from $400 – $550, with higher fees for more complex properties. Appraisals which may be used for litigation are more, sometimes with an hourly charge. Fees for expert witness testimony are $250 per hour.

The most common thing we are asked on the phone is “How much does an appraisal cost?” The answer is that it depends on the property being appraised, of course, and the purpose of the appraisal. If you want an estimate of value without us inspecting the property at all, we could charge as little as $150. If we don’t have to inspect the interior of the property and the purpose is not for divorce or litigation purposes, the fee can be as low as $275. Appraisals that require an inspection of the interior of the property run from $400 – $550, with higher fees for more complex properties. Appraisals which may be used for litigation are more, sometimes with an hourly charge. Fees for expert witness testimony are $250 per hour.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=df4804c8-8d48-4712-82f9-ada908198356)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=4e91c2be-1451-4784-ba39-9caa387dc169)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=91ac908e-7998-4cd8-9492-c12a85391473)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=51fa29e1-8317-425a-a2ee-37a8b375f037)